On December 6, within two days of the Dow’s all-time high, the Elliott Wave Financial Forecast offered this unique insight:

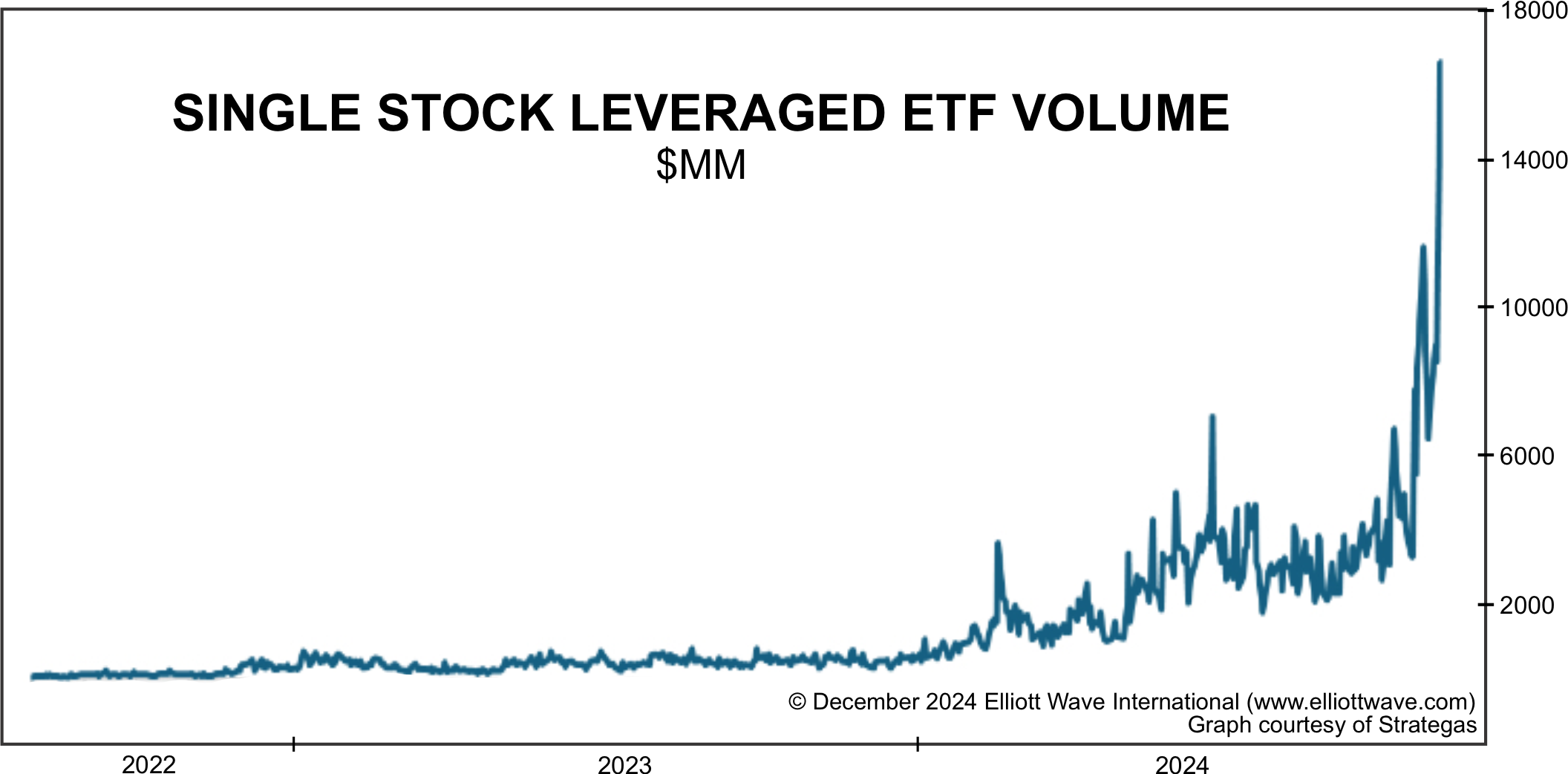

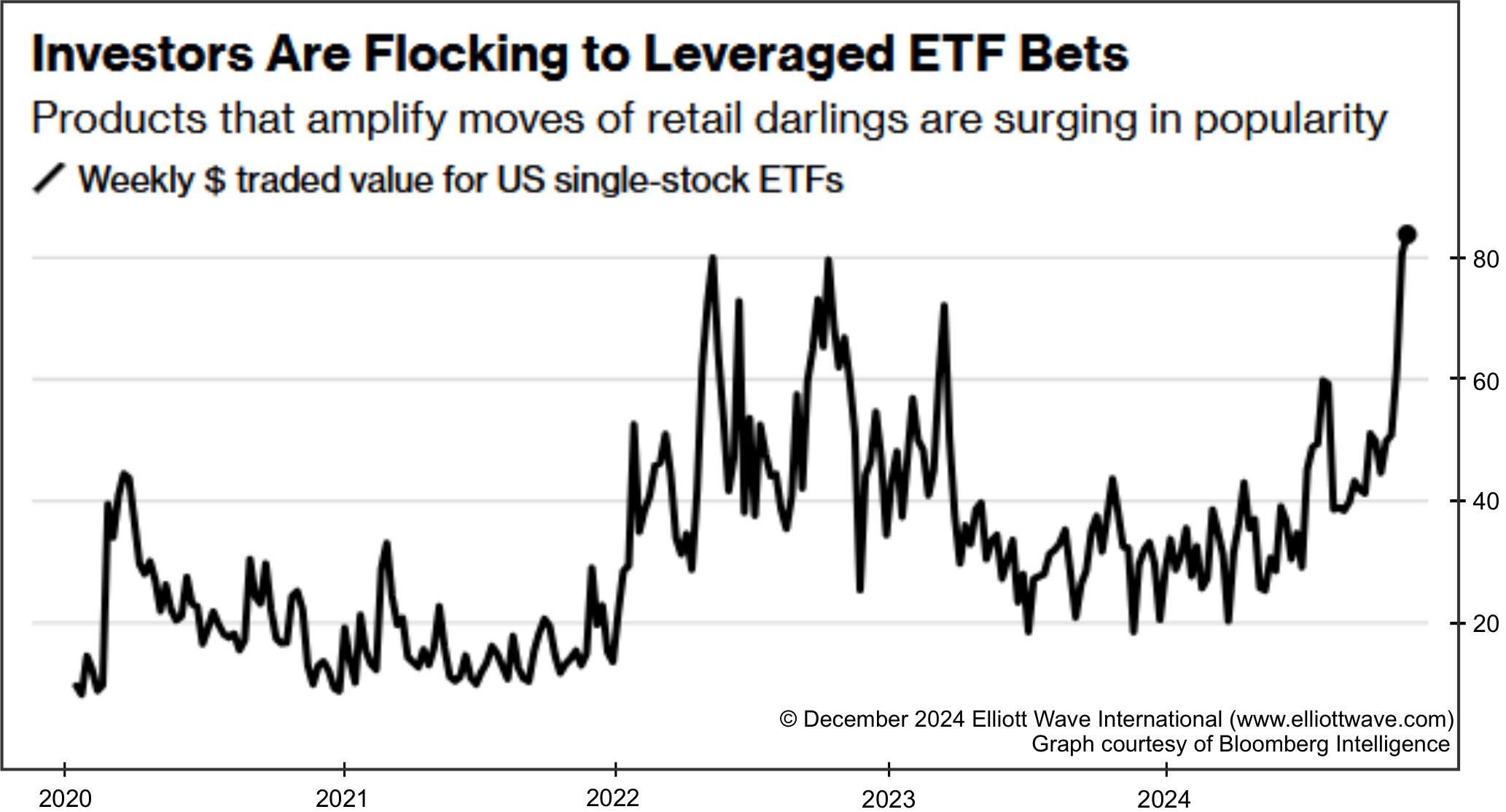

“Leverage is investors’ real-money way of expressing an extremely positive social mood, which prompts the thought, “I want more.” Investors always want the most at the end of any advance. The charts below show the merger of these two trends, as leveraged ETF volume now sports the classic verticality that invariably marks the end of a mania. Notice the ever more powerful risk orientation illustrated by the other chart of leveraged U.S. single-stock ETF bets. According to SentimenTrader.com, there are now $14 in leveraged long ETFs for every $1 in leveraged short funds, which exceeds the prior record from December 27, 2021, a month right between the market top in the NASDAQ in November 2021 and the Dow and S&P in January 2022. The ratio has surged a Fibonacci 62% since the end of October. Here, as in so many areas, riskier assets are experiencing the most rapid increases, signaling an impending exhaustion. Thanks to the miracle of modern financial engineering, leverage has seeped into every pore of finance.”

Were you reading EWI’s analysis as the stock market topped out? If not, find out what you missed. Read 4 FULL ISSUES (including the Dec. 6 EWFF) for free now.

Simply select the “STOCKS 4-ISSUE BUNDLE” and enter your email address for instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline ‘Investors always want the most at the END of any advance’. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Disclaimer: The Panic Newsroom is an affiliate of Elliott Wave International. As such, we may receive a commission if you order any products or services from their website. — TPN