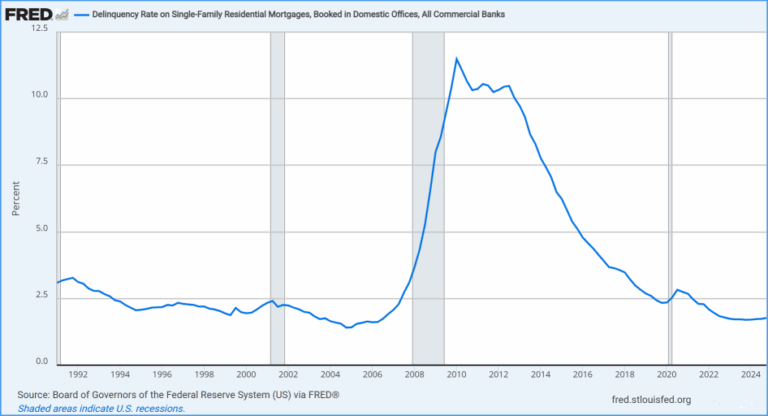

According the National Association of Realtors (NAR), existing home sales fell almost 6% MoM, and 2.4% YoY. Existing homes comprise approximately 90 percent of the single-family home sales in the U.S. Home sales data looks at the prices and the number of homes sold nationally. The data is collected by region, Northeast, South, Midwest and West.

Most real estate analysts are predicting further decline, especially if mortgage interest rates remain high. The current mortgage rate for a 30 Year Fixed-rate loan is 6.85%. It is unlikely that rate will decline this year. There is pressure being put on the Federal Reserve by the Trump Administration to lower interest rates, however, Chairman Jerome Powell does not seem to be obliging the President.

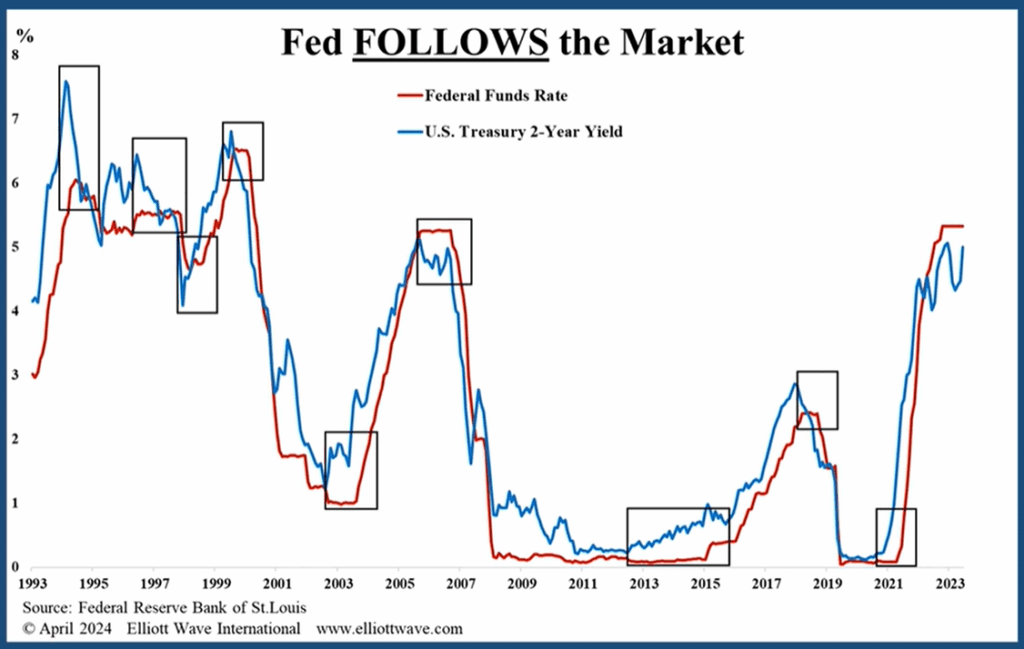

What few understand about interest rates is that, according to Robert Prechter of Elliott Wave International, the Fed does not actually control interest rates, it follows the market. As this chart from EWI clearly explains, the Fed only adjusted rates when the 2 Year Treasury Yield got too far away from its current Fed Funds rate.

So, even though the President could try to force the Federal Reserve to lower rates, if the market yields are going the other way, the Fed will have little choice but to follow the market.

As Treasury interest rates climb higher throughout the remainder of 2025, mortgage interest rates will certainly follow which will dampen any desire of potential home buyers to take the risk of home ownership.