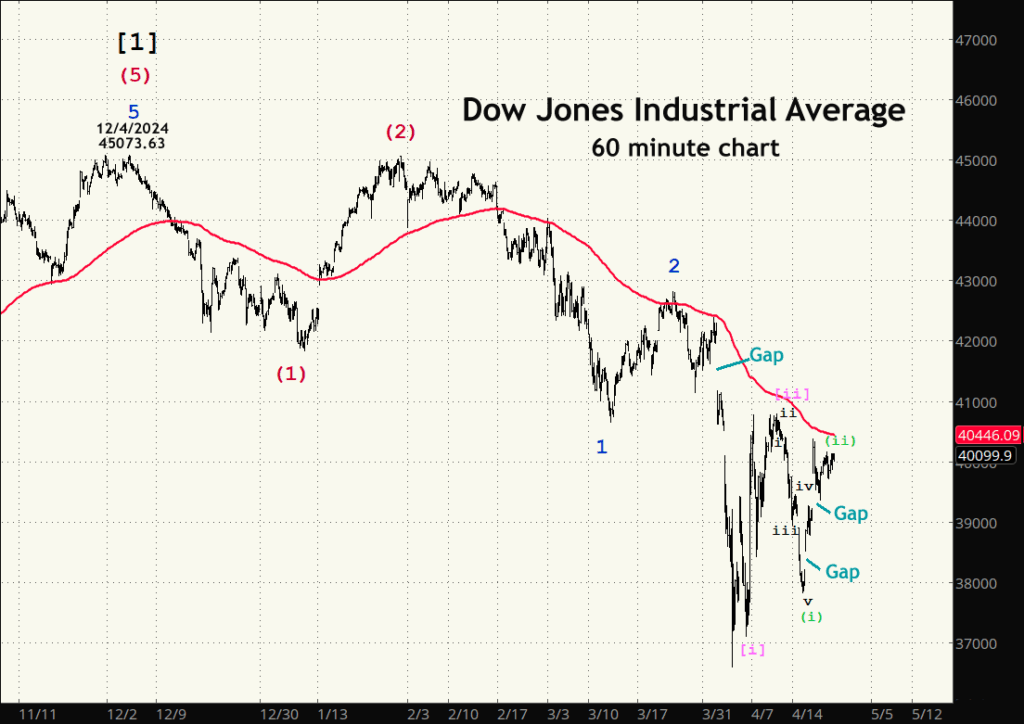

At Intermediate degree, we still do not have confirmation of a downtrend. It’s hard to tell whether, overall, the bulls or the bears are in charge. This chart is labeled bearishly, but there are alternate counts that would favor a bullish interpretation.

One of the more confusing factors is the very large top GAP. Gaps are like magnets, or more descriptively, like vacuums. Nature abhors a vacuum, as the saying goes. The market will do everything in it’s power to fill it before returning to the downward trend. This is a big one, 167 points I think. It will likely get at least partially filled. The other two are on the way back down, they will definitely get filled, eventually.

The current best count is that Minuette Wave (ii) is completing which should lead to a return to the downside in Wave (iii), that pesky gap not withstanding.

Next week may bring some clarity. But until the Dow breaks below its intra-day low of 38264.87 on April 4th, or the Dec 4th high of 45073.63, the markets direction remains ambiguous.