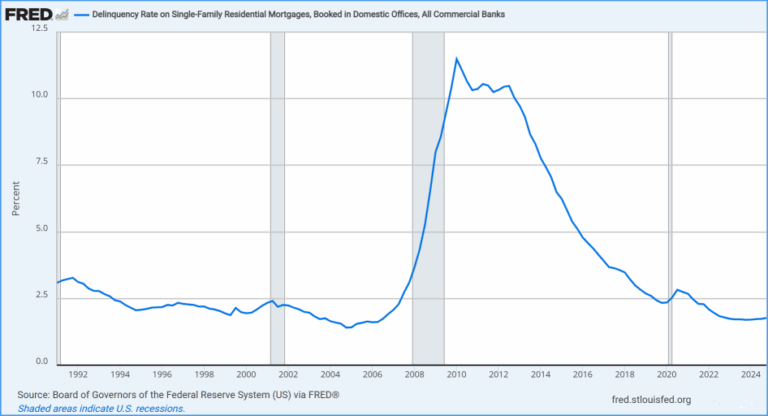

2025 is off to a difficult start for many businesses. Bankruptcies are expected to increase this year compared to years past. Especially hard hit will be mom and pop small business and small farms. Blamed is waning economic conditions, rising interest rates which make it harder for struggling businesses to get loans, and inflated operating costs for things like rent, fuel and labor.

But it’s not just small businesses that are feeling the crush of economic downturn. Restaurants like Burger King, Applebees, and Wendys are closing locations nationwide in an attempt to avoid bankruptcy as sales slump due to less traffic and higher prices. Other retailers such as JoAnn’s Fabrics and Kohl’s will shutter several locations in an attempt to stay afloat, an attempt many analysts believe may be difficult as consumers reign in their spending habits in favor of saving.

Not every company that files for bankruptcy goes out of business. There are several kinds of bankruptcy some of which can be used to protect the business from its creditors. There are six primary chapters of bankruptcy in the U.S.: Chapter 7 (liquidation), Chapter 9 (municipalities), Chapter 11 (reorganization), Chapter 12 (family farmers/fishermen), Chapter 13 (individual debt adjustment), and Chapter 15 (cross-border filings).

For businesses then, Chapter 7 and Chapter 11 are the two that govern most bankruptcies. Chapter 7 is invoked when a business has no chance of salvaging itself from destruction. In a Chapter 7 bankruptcy the business ceases operations. A trustee will then sell all of the businesses assets and subsequently distribute the proceeds to the company’s creditors. Any money remaining is returned to the company owners.

Chapter 11 is a great deal more advantageous to businesses which qualify. Most of the time the company can remain in control of its operations as a “debtor in possession”, which basically means the business is subject to the oversight of the court processing the bankruptcy. Chapter 11 is used to restructure the debts of the business in order to remain viable. Thus, for a Chapter 11 debtor to reorganize its business, the company must file (and the court must approve) a plan for reorganizing. The plan, then, is a compromise between the major stakeholders in the case, usually the debtor and its creditors. Reorganizations don’t always go well. When they fail, Chapter 7 is invoked and the company is liquidated.

Chapter 11 cases can be extremely complicated, too complicated to explain here, but done right, can save a company from failure when all parties involved are able to work together.

Already this year, 2025, 23 and Me, Excell Communications, Chiaro and several other major corporations have filed for protection. Others include, Bar Louie and Hooters in the restaurant space. 2019 and 2020 were tough years for many businesses due to Covid. But 2025 might challenge them all.